Recent Blog Posts

Personalized Annuity Options

Champaign, IL

Fully Licensed

Free Consultations

More Than 25 Years of Experience

Hours:

Request Lorem Epsom

Hero Request Form

Thank you for contacting us.

We will get back to you as soon as possible.

Please try again later.

Secure Your Financial Future with Annuities

At Advanced Financial Freedom, we guide you through the complexities of retirement planning. Our team offers tailored advice on annuities to help you build a strong financial foundation for your retirement years. An annuity provides a series of regular payments to an individual. It can be structured to pay out for a fixed period or for the lifetime of the recipient. We serve Central Illinois and nearby areas, creating custom strategies that align with your retirement dreams. We proudly offer:

- Fixed annuities

- Indexed annuities

- Immediate annuities

Plan your retirement with confidence.

Contact us today to discover how annuities can enhance your financial plan.

Signs You Might Benefit from Annuities

Annuities can be a valuable addition to many retirement plans. Advanced Financial Freedom can help determine if they're suitable for you. Consider these common indicators:

- You want guaranteed income in retirement

- You worry about outliving your savings

- You're interested in tax-deferred growth

- You need to supplement Social Security or pension

- You want to plan for your beneficiaries

- You seek protection from market ups and downs

If these points resonate with you, it might be time to consider annuities for your retirement plan. Our team at Advanced Financial Freedom is ready to walk you through your options.

Contact us today for a consultation.

Why You Might Need Annuities in Your Financial Plan

Annuities offer unique benefits that can address specific retirement needs. Here's why you might include them in your financial plan with Advanced Financial Freedom:

- Provides regular income

- Offers tax-deferred growth potential

- Helps manage longevity risk

- May include death benefits

- Can be customized to your needs

- Offers some protection from market downturns

Why Choose Advanced Financial Freedom

When planning your financial future, trust and knowledge are crucial. Advanced Financial Freedom is your committed partner in retirement planning:

- Family-run business offering personal service

- More than 25 years of financial planning experience

- Free consultations, including online options

- Focus on debt-free retirement planning

- Partnerships with major insurance companies

- Awarded Elite Circle Of Champions 2023

- Deep roots and understanding of Central Illinois

Contact Us

Are you ready to plan for a secure retirement? Advanced Financial Freedom can guide you through annuities and help create a solid financial plan. Our experienced team is committed to providing excellent service and trustworthy advice tailored to your specific needs. Start securing your financial future today. Contact us to book your free consultation and learn how annuities can support your retirement strategy.

What is an annuity and how does it support long-term financial freedom?

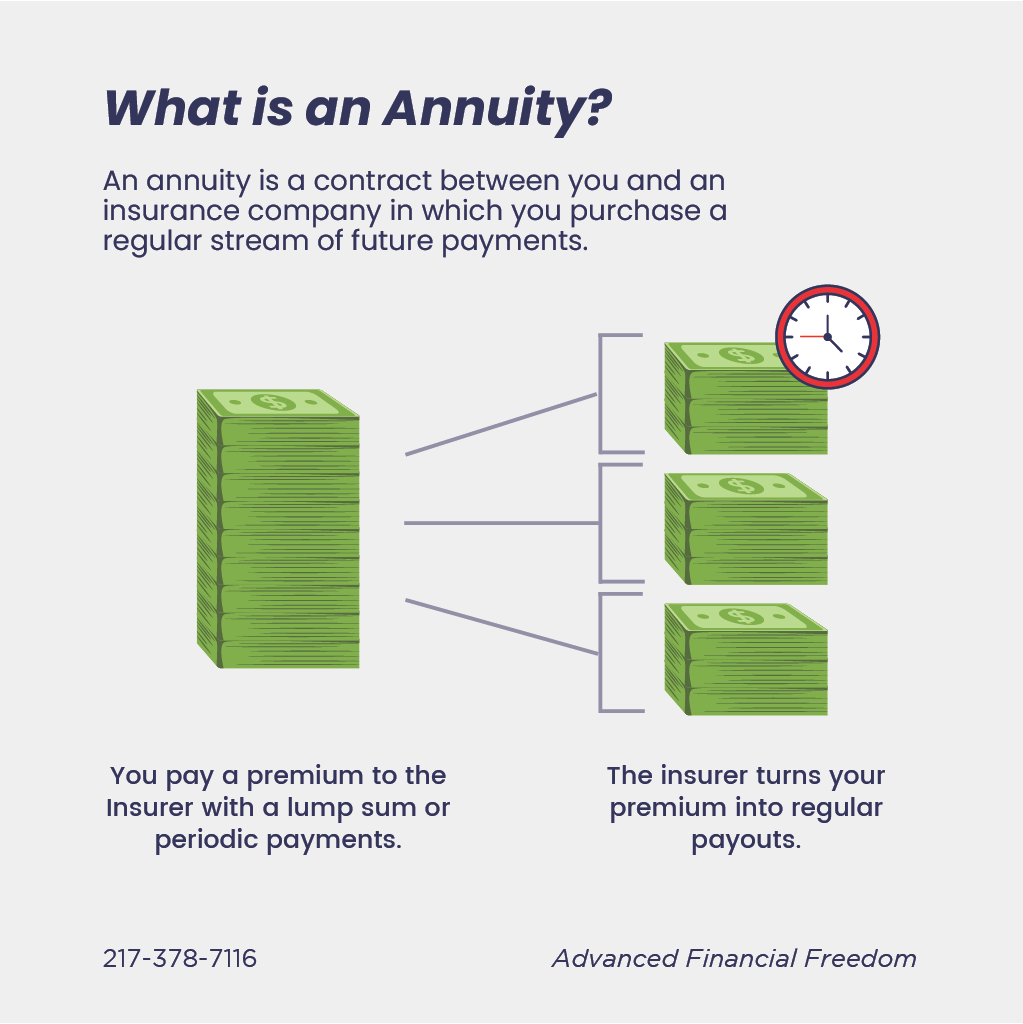

An annuity is a financial product offered by insurance companies that provides a stream of income, typically during retirement. You invest a lump sum or make periodic payments, and in return, the annuity pays out regular income either for a set period or for the rest of your life.

For those pursuing advanced financial freedom, annuities offer predictable cash flow, tax-deferred growth, and protection against outliving your savings, making them a strategic tool in a diversified retirement plan.

What are the key differences between fixed and variable annuities?

Fixed annuities guarantee a set interest rate and predictable payouts, making them ideal for conservative investors seeking stability.

Variable annuities allow you to invest in sub-accounts (similar to mutual funds), and your returns—and future payouts—depend on market performance.

While fixed annuities offer security, variable annuities provide growth potential but come with higher risk and fees.

Choosing between them depends on your risk tolerance and retirement goals.

Reviews

Retire Debt Free