Text

Msgs may be autodialed. Consent to texts not required to purchase our svcs. Msg. and data rates may apply.

Was your business negatively impacted by the Covid-19 pandemic?

You are likely eligible for the Employee Retention Credit (ERC) of up to $26,000 per employee.

The ERC program was created under the Coronavirus Aid, Relief and Economic Security Act (CARES Act) as part of the federal government’s relief program to encourage and reward business owners that retain employees during the pandemic. Recently, the policy was amended to enable business owners to qualify for ERC tax credits even if they received PPP loans. The time period the program covers was also extended from March 22, 2020 to December 31, 2021.

Does your business qualify?

Your business qualifies for ERC if you experienced a partial or complete suspension of operations

Your business qualifies if you experienced a significant reduction in revenue during

any quarter of 2020 or 2021 as compared to 2019.

ERC Eligibility

For 2020, if your business was fully or partially suspended, was forced to restrict business hours, or experienced a reduction of 50% or more revenue (gross receipts) as compared to the same quarter in 2019, you are eligible for ERC tax credit. If your business meets this requirement, you are eligible for the ERC tax credit equal to 50% of eligible employee wages.

Maximum credit per employee: $5,000

For 2021, if your business was fully or partially suspended, was forced to restrict business hours, or experienced a reduction of 20% or more revenue (gross receipts) as compared to the same quarter in 2019, you are eligible for ERC tax credit. If your business meets this requirement, you are eligible for the ERC tax credit equal to 70% of eligible employee wages.

Maximum credit per employee: $21,000

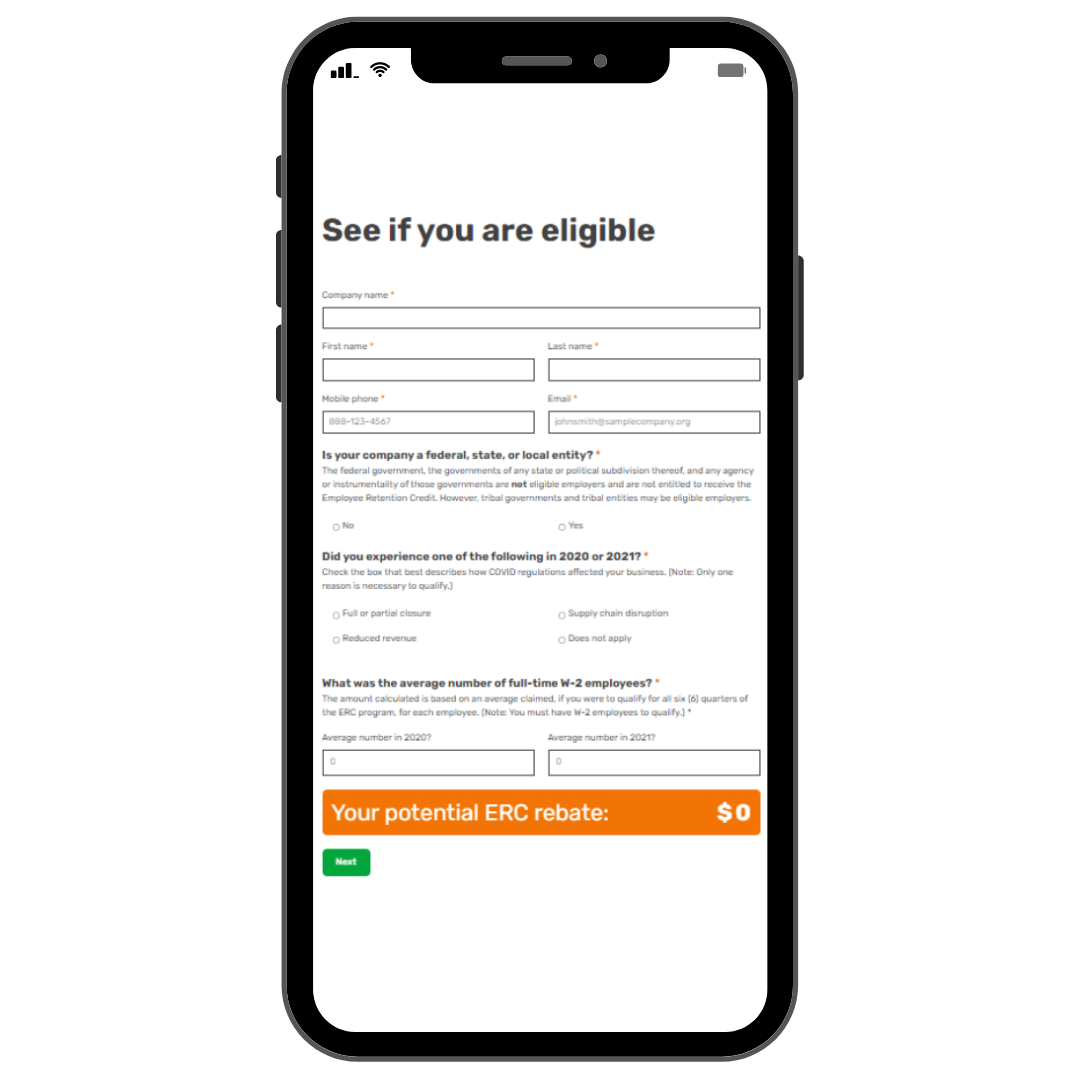

Take the Quiz to find out if you qualify.

Simply input your business information into our system. The answers will determine whether or not you are eligible. If you are a candidate, we'll even provide an estimate of how much you could receive in ERC rebates.

Free Consultations

on Employee Retention Credit

Call today!

(217) 250-2435

Share On: